Payment methods: credit or debit card, Klarna

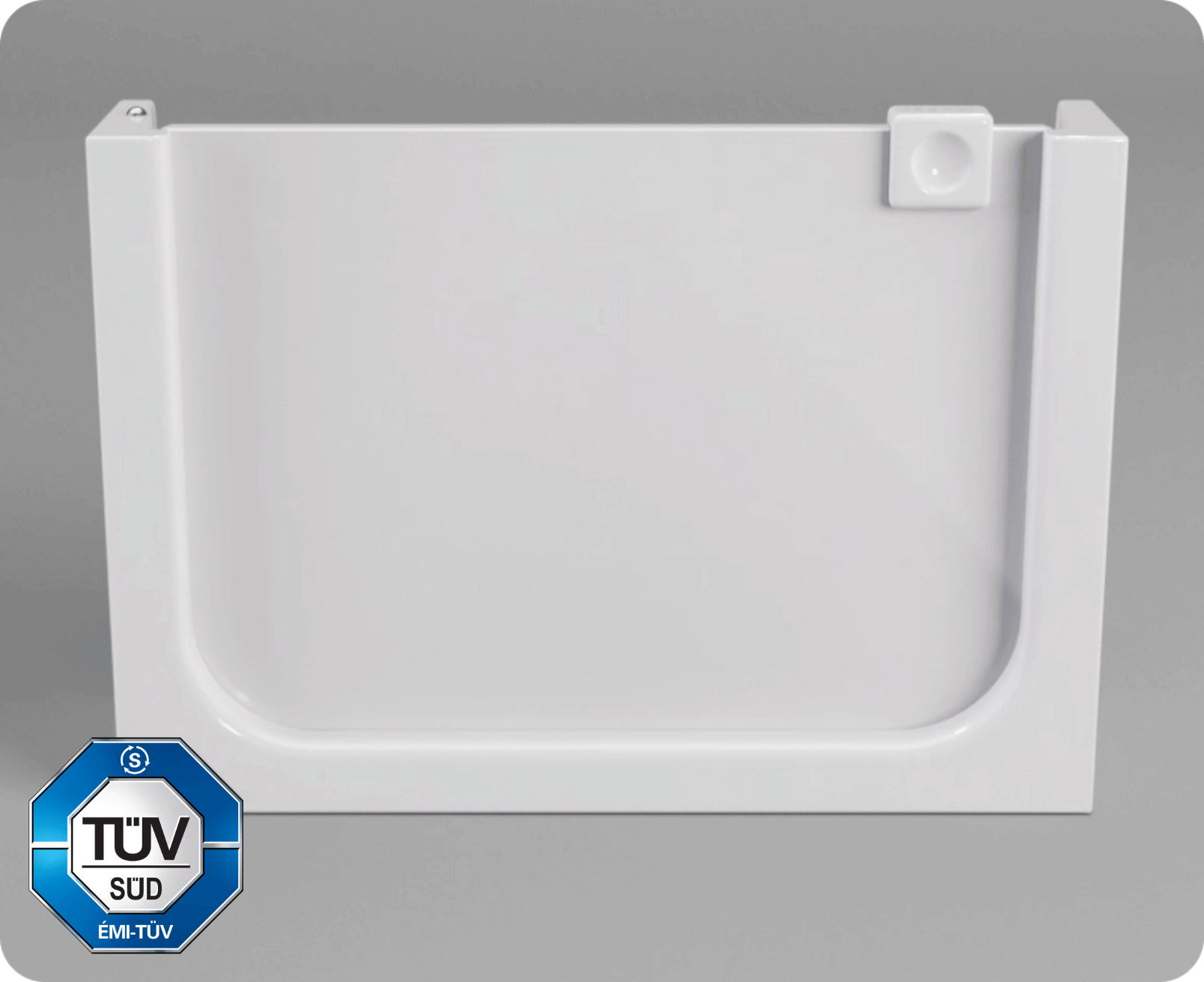

UDOOR® bathtub door with installation

£1,490 – £1,788

Estimated installation: 16/02/2026 – 23/03/2026 depending on your location

We can install UDOOR® bathtub doors into baths made of any material and shape

Additional accessories

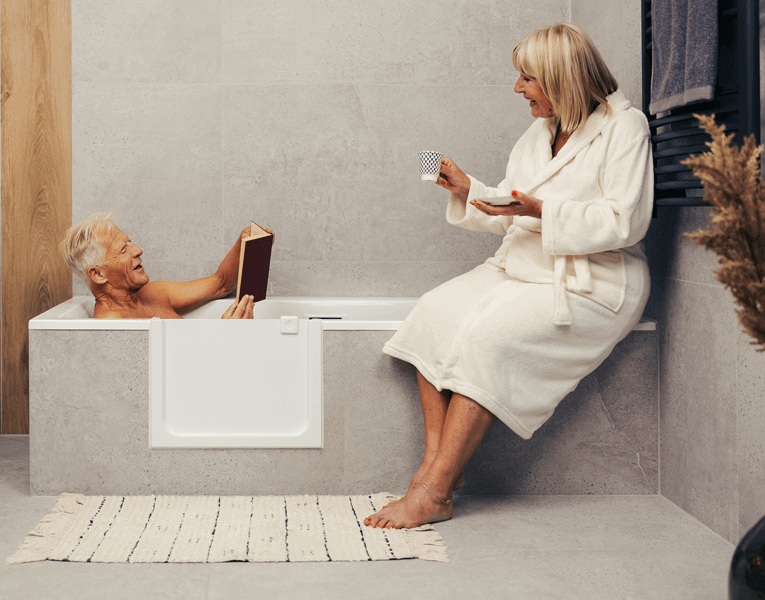

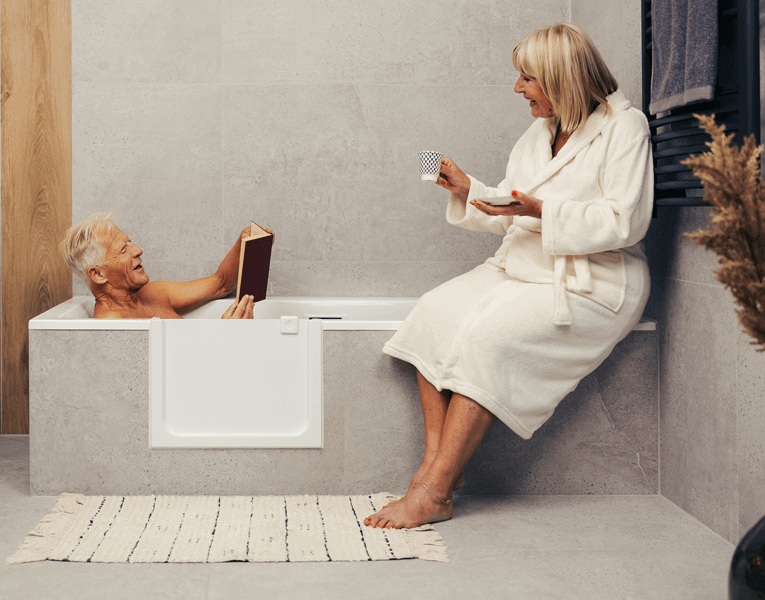

It can be that easy to enter your bath with UDOOR

Easy showering and bathing for the whole family

Safe and secure

Easy to operate, simple to clean

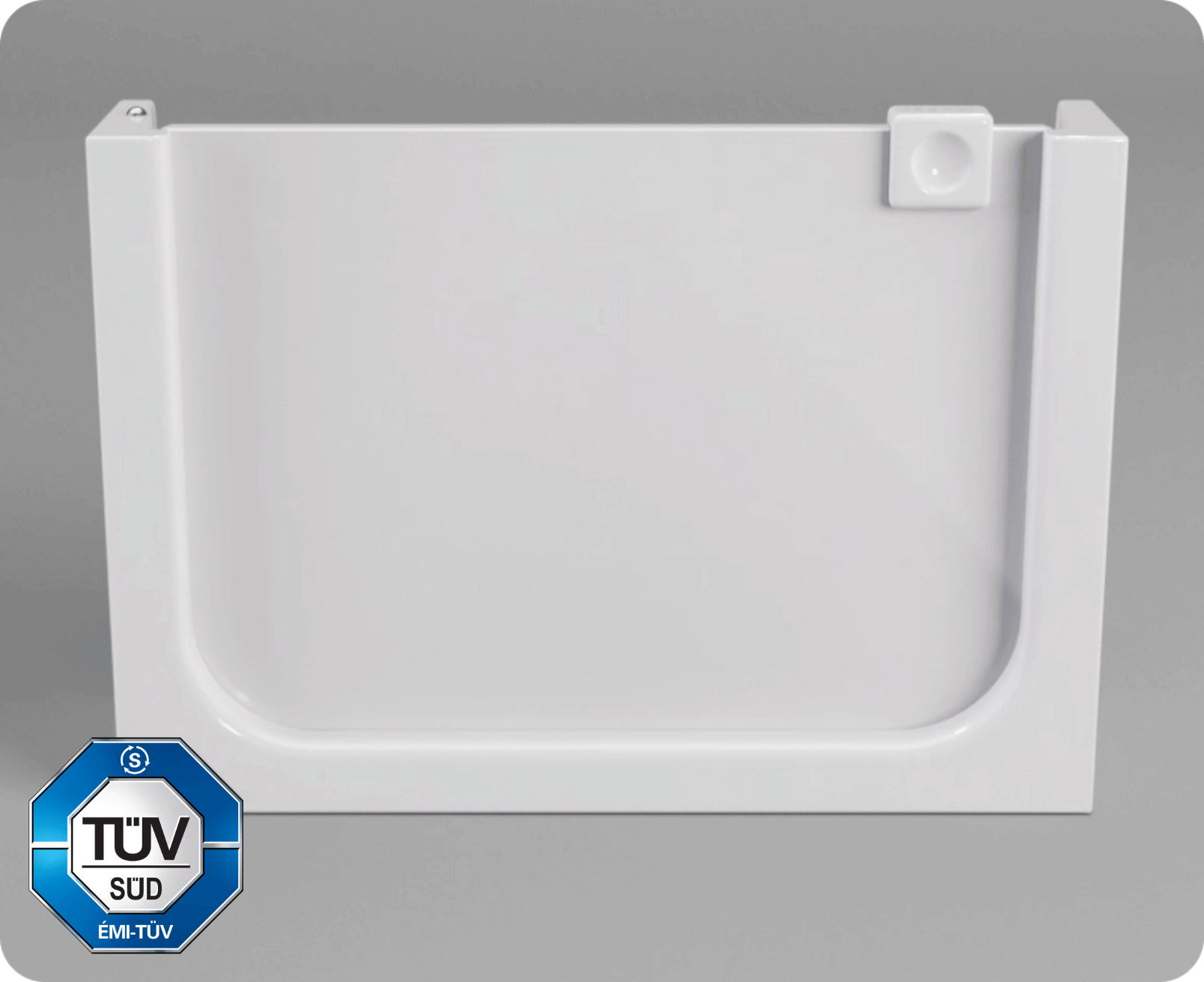

The minimalist design makes the UDOOR® bathtub door fit seamlessly into any bathroom style, from modern to traditional. Cleaning is a breeze due to its smooth surfaces so regular upkeep is quick and hassle-free.

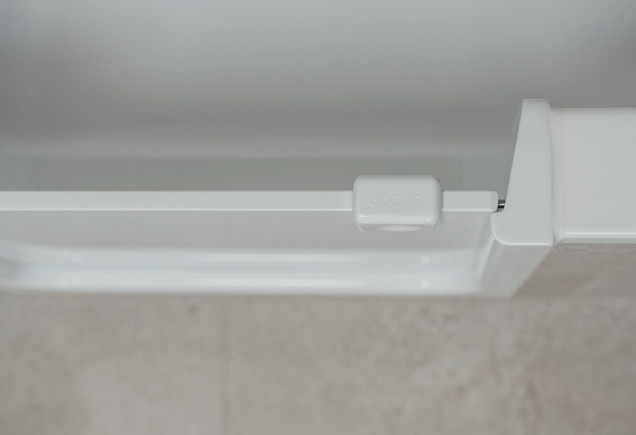

The ergonomic locking system and minimalist design, set a new standard for practicality and refinement in bathroom accessibility.

High quality materials with TÜV-SÜD certification

Our engineers

Bathroom transformation in just a few hours

Placement of the door

Protecting the bathroom

Precise cutting

Installation

Cleaning

Technical details

Size

Width: 455 mm Height: 320-400 mmPlease contact our customer service for custom sizesMaterial

Plastic, stainless steel, medical grade siliconeCertification

TÜV-SÜD Quality with safety technical complianceAvailability

Can be installed in any type of bath.Cleaning

Easy-to-clean surfaces

We love UDOOR® because...

How can we help you?

How can we help you?

Are You Eligible for VAT Relief?

If you have a long-term illness, disability, or are aged 60 or over, you may be entitled to VAT relief when purchasing a UDOOR. Below, we’ve explained who qualifies and how the process works.

Who Qualifies for VAT Relief?

VAT relief applies to individuals who meet the following criteria:

✅ 0% VAT Long-Term Illness or Disability

You may qualify for 0% VAT if you have:

- A physical or mental impairment that significantly affects daily life (e.g., blindness, stroke, Parkinson’s, dementia).

- A long-term illness recognised by medical professionals (e.g., arthritis, diabetes, COPD, ME).

- A terminal illness.

🔹 Please note: If you are over 60 but otherwise in good health, or if your condition is only temporary (such as a broken bone), you won’t be eligible for VAT relief at 0%.

✅ 5% VAT Aged 60 or Over

- If you’re 60 or older, you can benefit from a reduced VAT rate of 5%.

✅ 20% VAT Standard Rate

If you are under 60 and do not meet the above criteria, the standard VAT rate of 20% applies.