UDOOR Bathtub door incl. installation

£ 1,390 – £ 1,668

* Prices are for installations in England or Wales. Please contact us for installation in other areas.

Description

ALMOST ANY BATH

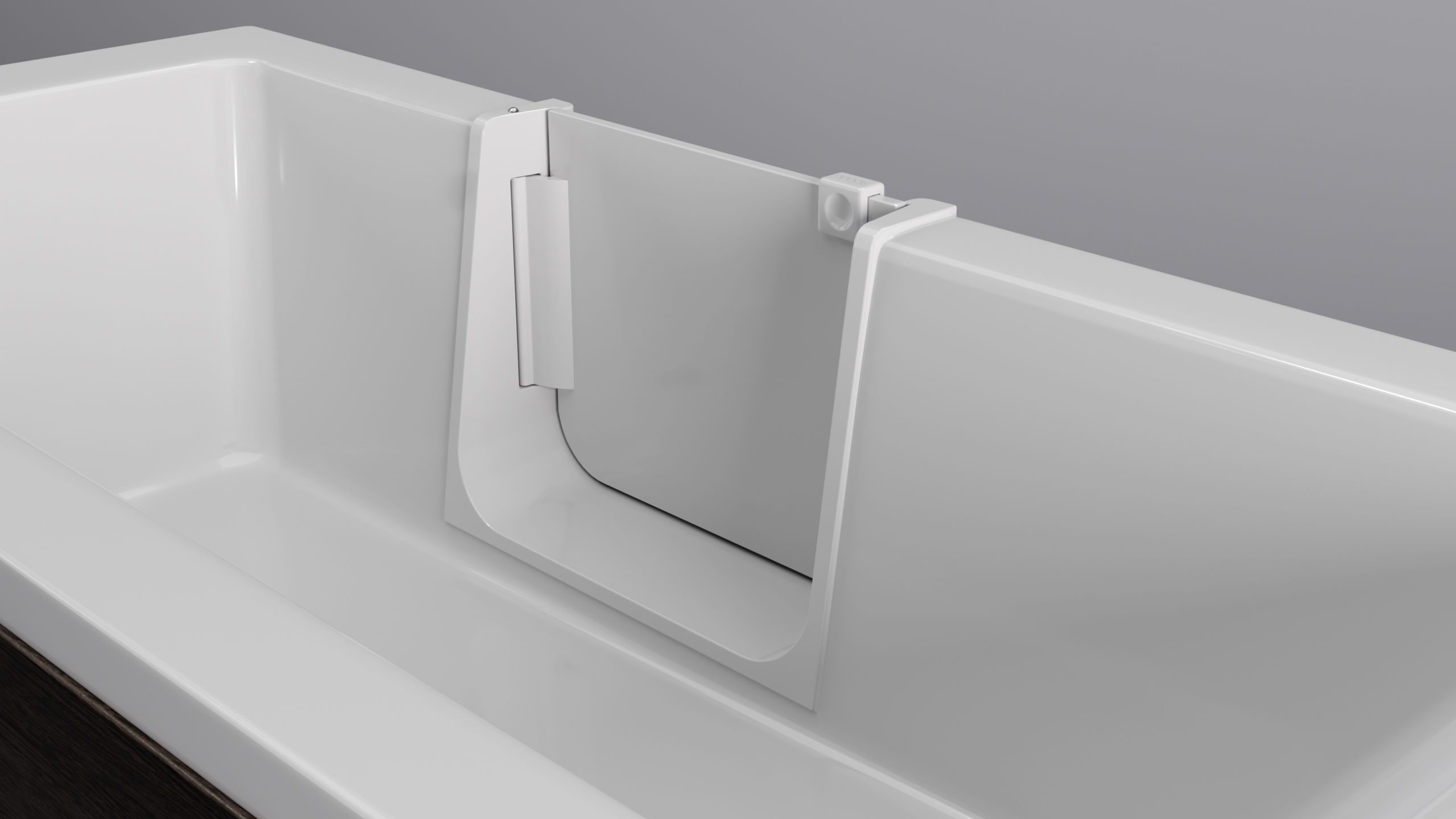

The UDOOR Bathtub door can be installed into almost any bath. Our door has been designed so that it can be installed into curved surfaces like on P-shaped baths and corner baths and we will work with you to make sure you get the placement you want.

EASY TO USE

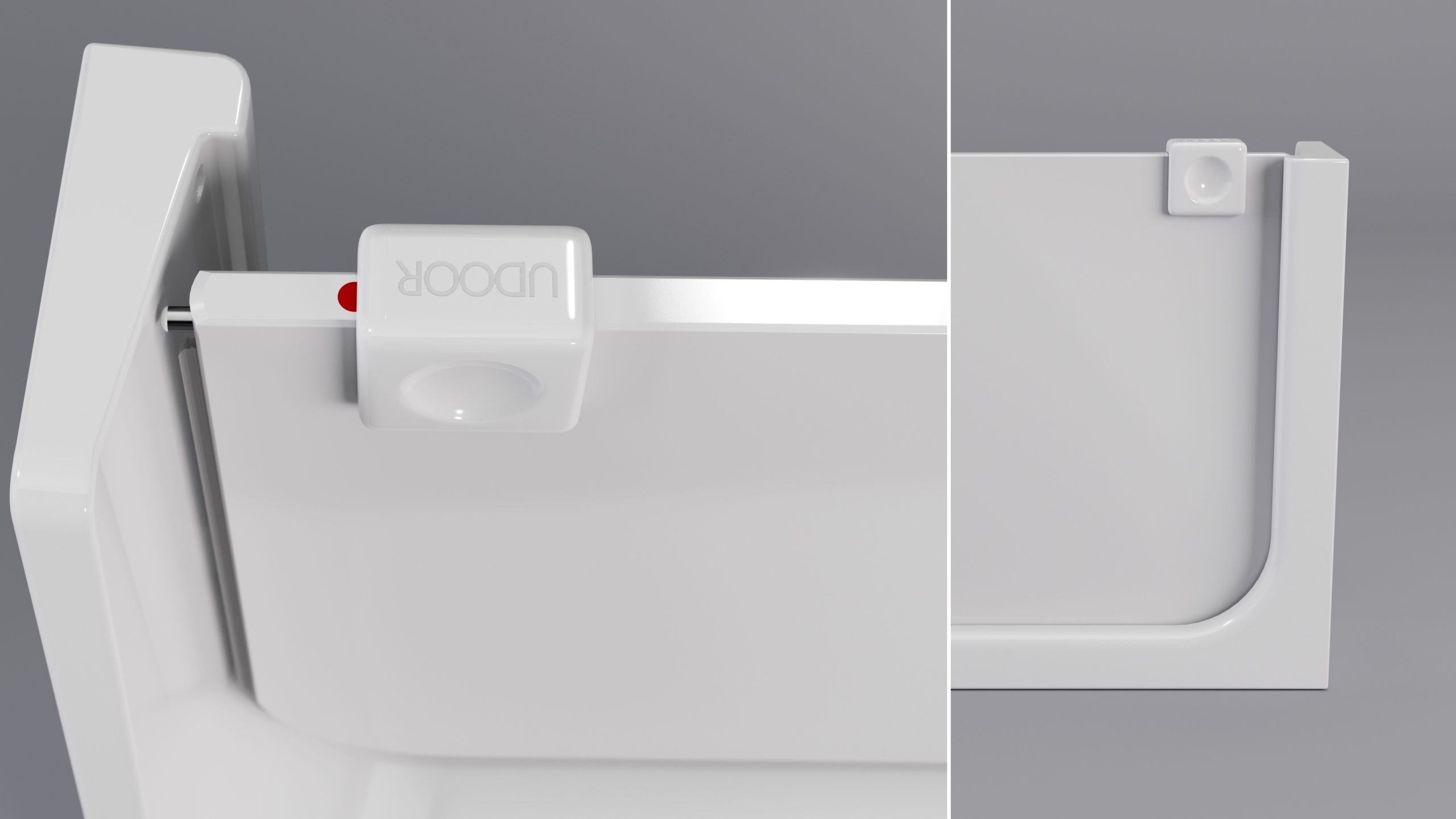

The door is easy to use. It automatically locks when closed adding an extra level of security and peace of mind when bathing. To open and unlock the door simply slide the lock to the side.

UNIQUELY SHAPED TO YOUR BATH

Each door is installed with the utmost of care. Our skilled team are able to sculpt the frame of the UDOOR Bathtub door to match the inside of your bath so that you get a flawless finish.

MANUFACTURED IN EUROPE

We designed the UDOOR with a highly adaptable frame so it can be fitted into almost any bathtub. Each element of the UDOOR has been crafted with the aim of being long-lasting and easy to use. Our unique design means that we can install a UDOOR into a straight or curved surface and sculpt the frame so you get the best finish possible.

FROM START TO FINISH

We are with you every step of the way, offering clear pricing, professional advice and an installation service that is second to none.

We only send our staff out to install our bathtub doors. That way we know that you are answering your door to someone you can trust. Our fitters have extensive experience and knowledge when it comes to installing your bathtub door. All of our staff go through strict training so that they fit every single UDOOR Bathtub door perfectly.

Additional information

| Weight | 10 kg |

|---|---|

| Dimensions | 25 × 45 × 40 cm |

| Select VAT rate: | 0% Long term illness or disability (see info), 5% Reduced rate, aged 60 and over, 20% Standard rate, aged under 60 |

Nationwide installation

Nationwide installation